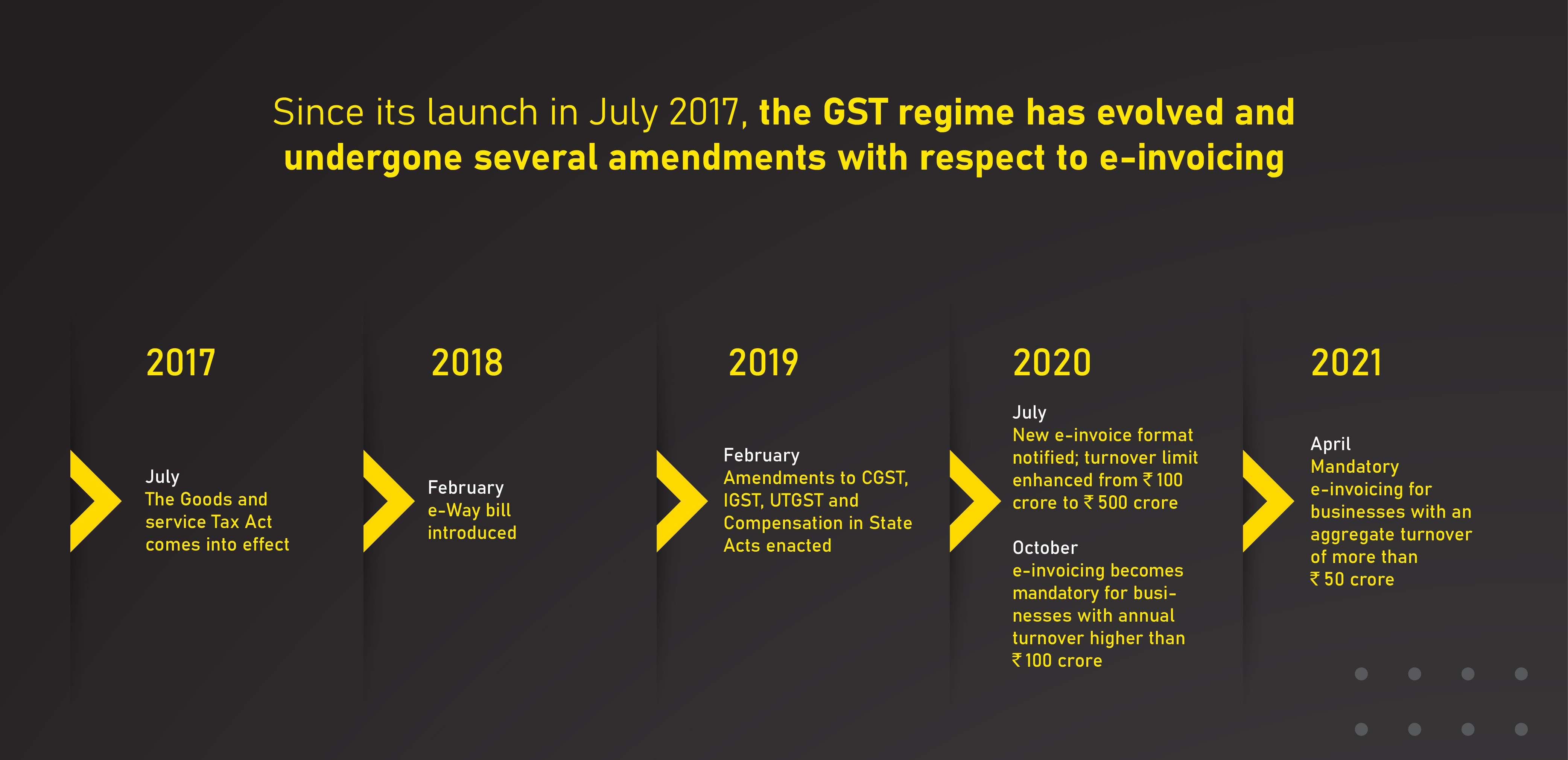

Last year India witnessed a seminal shift in Digital Tax Administration. The post-clearance reporting mandated under the GST regime has now been replaced by pre-clearance e-invoicing processes. This has triggered a paradigm change for organizations from a technology, process, and people perspective. Dun & Bradstreet in association with EY & SAP, hosted a virtual engagement addressing the same and also discussed DigiGST®, a holistic GST compliance solution on the SAP Business Technology Platform.

GST council, for the very first time, recommended the implementation of e-invoicing under GST during the 35th GST Council meeting held on 21 June 2019. E-invoicing has changed the commercial landscape along with tax and regulatory requirements. Governments have gained incisive insights on day-to-day transactions of organizations along with amendments in the GST legislation that integrally link compliances of internal and external supply chains with input tax credits.

Focused on this evolution of Digital Tax Administration for GST the Evolve to Solve: GST E-invoicing & compliance integration with SAP featured financial leaders from forward-thinking organizations including – Mr. Anand Raisinghani (Vice President & Head Professional Services, BFSI Telecom & Media, SAP Indian Subcontinent), Mr. Uday Pimprikar (National Leader, Indirect Tax, EY), Mr. Utkarsh Sanghvi (Indirect Tax Leader, EY), Mr. RVN Vishweshwar (Chief General Manager, Finance, Marketing, Indian Oil Corporation Ltd.), Mr. Divyesh Lapsiwala (Partner – Indirect Tax, EY), Mr. Tapas Dutta (Chief Technology Officer, Duroflex), Mr. KSV Rajagopal (General Manager IT, TAFE-Tractors and Farm Equipment Ltd.) and Mr. Nitin Mishra (Tax Technology & Transformation Partner, EY).

Discussion points through the webinar covered challenges faced by organizations at the time of the introduction of e-invoicing; strategies adopted to deal with these challenges, specifically with regard to processes and technology.

Changing Tax Landscape

During the Keynote Address our experts reflected on the rapidly evolving Indian tax – mimicking the global trends with a keen focus on the processes. Like a moving goal post, this situation requires constant attention, interpretation, and knowledge on how the regulators are thinking ahead for the quarters to come.

This rapid change is pushing one and all to evolve into more dynamic, more integrated, and more technology-focused organizations. By taking the right steps you can at a very early stage identify all the tax risks that resonate in your organizations or could come into processes.

Compliance & Complications

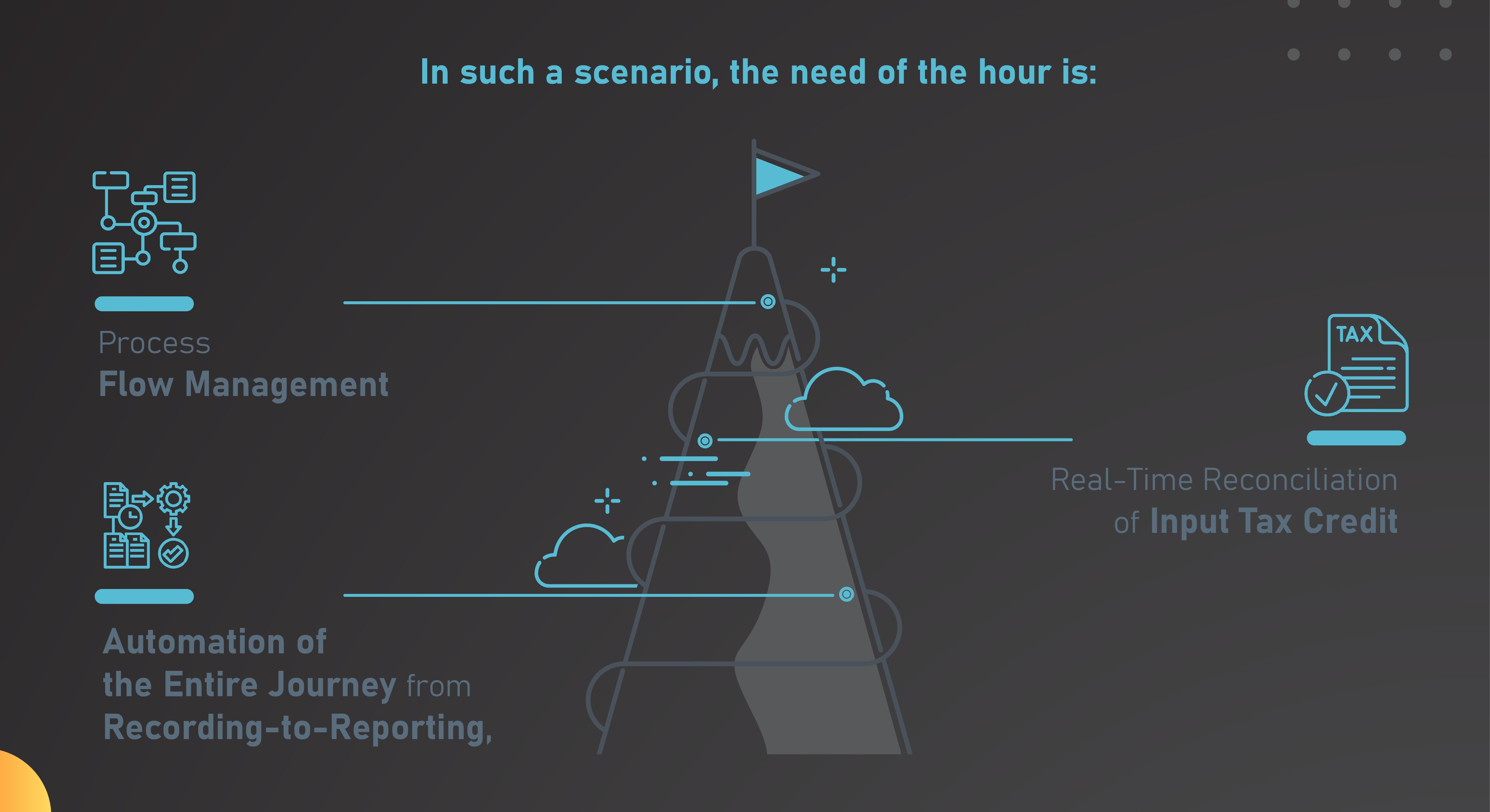

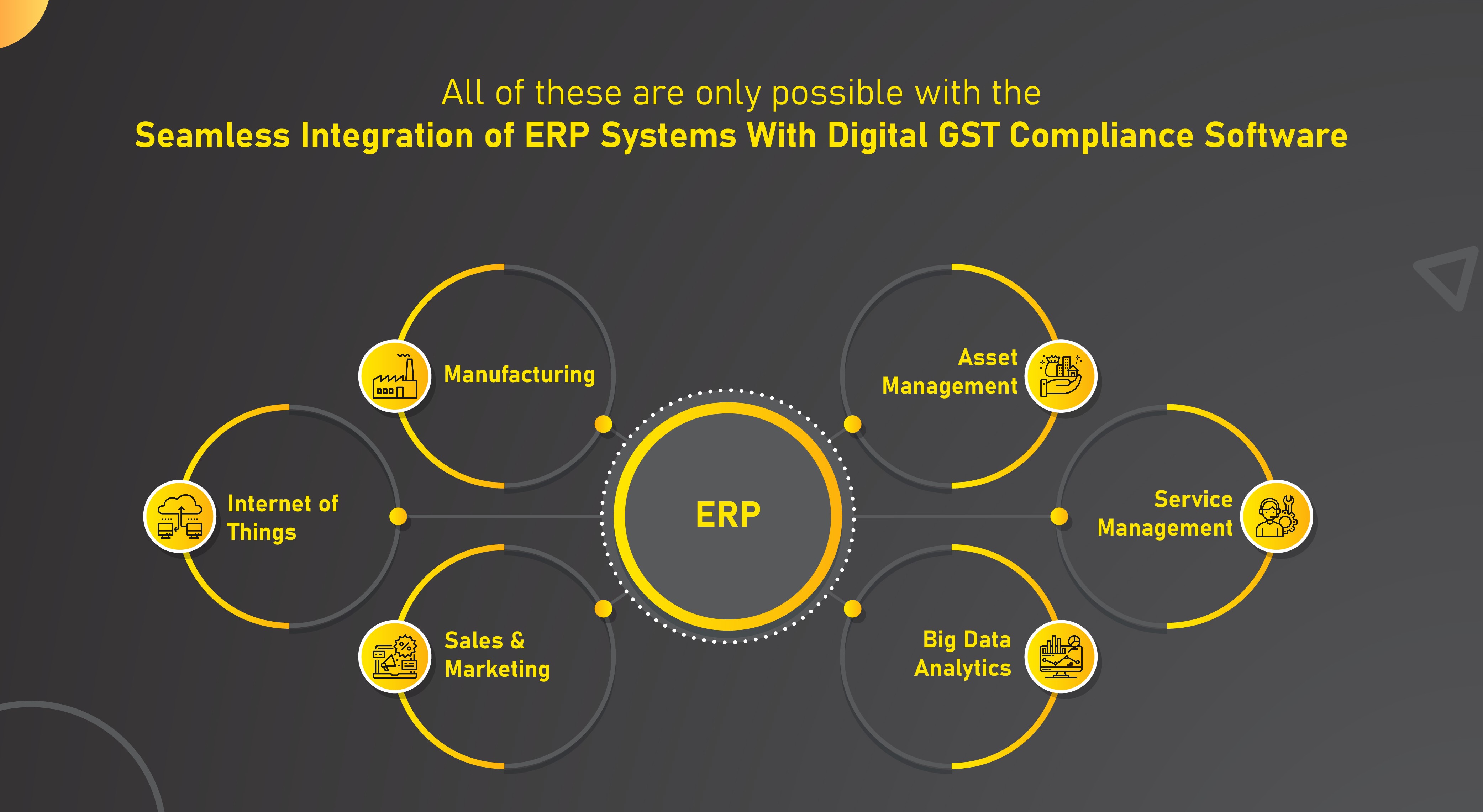

While at a conceptual level, the steps that the government has worked on for the digitalization of the tax processes have built a significant number of opportunities. The panel closely examined the flip side of this situation, discussing the substantial number of complications for compliances from the technology perspective e.g., balancing of the overall traffic, forward integration with the government and reverse integration into ERP.

This integrated approach towards compliances necessitates a significant change in tax commercial and finance work processes. Organizations need to handle multiple requests in real-time, while, ensuring reconciliations of both procurements and revenue reported on the GSTN portal with internal books.

For a successful migration, you need to re-evaluate the adequacy of your existing compliance processes, their stability, and their flexibility to adapt to regular legislative and procedural changes. DigiGST can be very helpful to the process of reviewing your existing business processes and correct the same.

DigiGST® – A Holistic GST Compliance Solution

EY has brought its entire experience as the largest GST advisory firm in India with proven managed tax compliance services functions to develop a solution with SAP that will enable organizations to meet these granular and accurate reporting requirements seamlessly and efficiently.

DigiGST® is an intelligent and intuitive tax automation solution that fulfils GST compliance requirements such as e-invoicing, eWaybill, and GST returns on SAP Cloud PaaS Services and clients’ SAP enterprise resource planning platforms.

The panel also explored how not only does it use business-critical APIs service across primary and secondary regions and multiple security certifications, but it also reviews critical finance functions, for mitigating existing tax risks while ensuring data privacy via secure end-to-end data encryption.

Realizing benefits with DigiGST®

EY has spent a significant amount of time from product management within SAP to go the extra mile to ensure that the entire integration is seamlessly managed on SAP technology and powered to drive one tax initiative combining direct & indirect tax.

Key Takeaways From Event:

- The introduction of e-invoicing, as approved by the GST Council, and the proposed new GST return system have replaced the earlier post-clearance reporting with a pre-clearance e-invoicing process.

- This demands an integrated approach towards compliance that necessitates a significant change in tax commercial and finance work processes.

- Organizations need to evolve to become more dynamic, integrated, and technology-focused to handle multiple requests in real-time, while, ensuring reconciliations of both procurements and revenue reported on the GSTN portal with internal books

- DigiGST® is an intelligent and intuitive tax automation solution that fulfills GST compliance requirements such as e-invoicing, eWaybill, and GST returns on SAP Cloud PaaS Services and clients’ SAP enterprise resource planning platforms.

- Not only does it review critical finance functions, for mitigating existing tax risks it also ensures data privacy via secure end-to-end data encryption.

- More than INR 2,80,000 cr of tax liability have been reported through DigiGST® annually & 9% of total invoices submitted to GSTN are reported through DigiGST®.

Explore seamless integration of SAP ERP systems with a Digital GST compliance software that can help your business make the shift from tax compliance to tax efficiency.