The finance industry has been under a ‘digital spell’ for quite some time now–unlike many other sectors, which put the pedal to the metal to drive digital transformation only recently. Yet, banks and traditional financial institutions continue to face increased competition from newer digital intermediaries, such as the fintech sector. Meanwhile, the pandemic accelerated the adoption of digital banking services by consumers of all ages. Thus, to remain competitive, banks had to move from a digital-friendly model to a digital-first future.

Here are some of the numerous factors that prompted this radical shift to the digital:

- Declining branch traffic and the rise of mobile banking apps: A recent survey by S&P Global Market Intelligence found that 51% of respondents confessed to visiting bank branches less frequently due to the ongoing pandemic. Of those, more than 65% claimed to also use mobile apps more frequently. The most popular mobile banking feature among the respondents was the ability to use the photo check deposit (24%), followed by account-to-account money transfer, bill payment, and peer-to-peer payments (20%). In fact, banking conglomerate JPMorgan Chase & Co. announced that its active mobile user count grew by 9% to 42 million users. Naturally, banks are reducing their physical footprint to go deeper into the digital realm

- Changing customer needs and expectations: According to a survey by PwC, 20-25% of consumers wish to open a new account digitally but cannot do so today. There’s a marked change in the way customers want to engage in financial transactions and activities. Clearly, banks that fail to rise to the occasion will lose out to the competition.

- Heightened competition from non-traditional players: Tech giants Amazon and Google are making headway into the banking space. Google Pay claims that the number of UPI transactions on its platform is doubling each month, with the total number of transactions touching 4.2 billion in October 2021. The company has highlighted the importance of preparing its infrastructure to cater to the fast-rising demand. Meanwhile, Amazon Pay has partnered with a wealth management platform, Kuvera, to allow users to facilitate investments into mutual funds, fixed deposits, etc. Considering this field’s immense scope, it is only natural to expect that more and more tech companies will want a slice of the pie. This will increase the competitor pool of traditional financial institutions.

- Skyrocketing use of innovative technology: From cloud computing and smartphones to digital currencies and blockchain technology, there are numerous technological tools that are driving digital disruption in the banking sector. One interesting example is the rise of Robo-advisors, which are computer programs that provide investment advice to customers. This is done by analyzing the customer data in real-time and extracting emerging patterns as well as trends to make the ‘advice’ relevant and engaging. The increasing popularity of business analytics service solutions in different fields, leading to the development of tools such as SAP BusinessObjects Cloud, is another example.

Needless to say, all these fast-paced developments have driven banks and financial institutions to revisit their offerings, restructure their current growth strategies, and understand their true place (and potential) in the digitally powered financial ecosystem.

Emerging Digital Trends Reshaping the Financial Industry

the current wave of digital transformation has the potential to drastically alter the banking sector. With the help of breakthrough technologies and innovative offerings, financial players are looking to hyper personalize consumer experience and enable smoother journeys.

Here’s how the industry is leveraging digital transformation to transform every juncture in the customer’s journey:

-

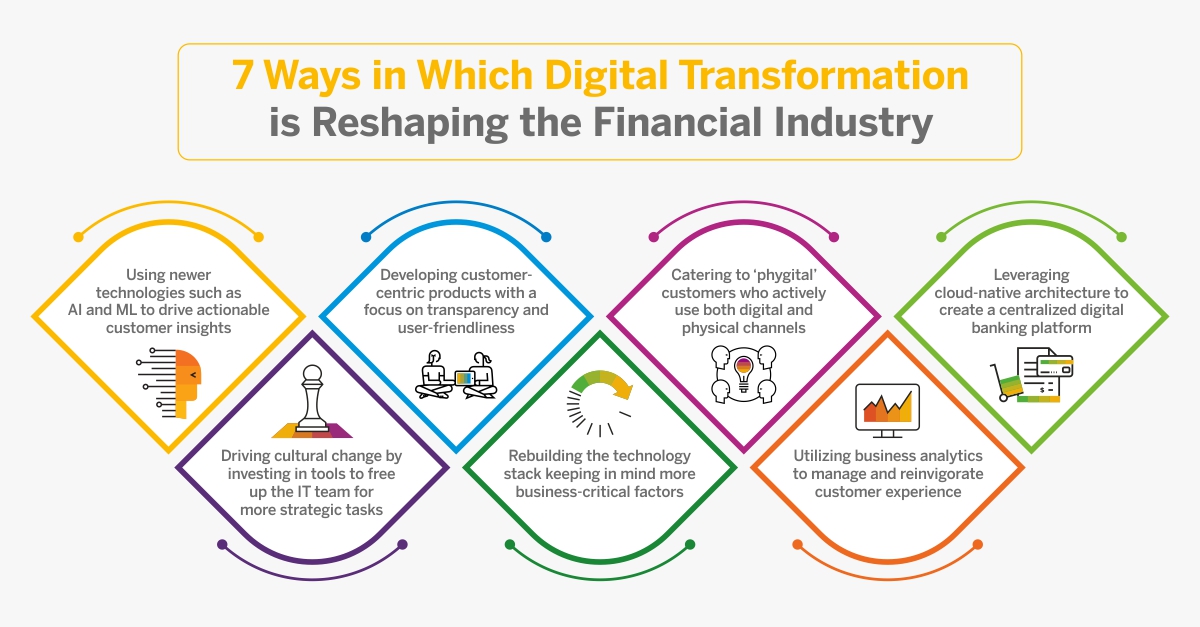

Using newer technologies:

Banks are leveraging a heady combination of Information Technology, Big Data, and specialized human capital to gain a competitive edge. With the help of futuristic technologies such as artificial intelligence (AI) and machine learning (ML), banks can process high volumes of customer data and drive actionable insights to improve customer experience. For example, HDFC leverages the services of ‘Eva’, an AI-powered chatbot that can efficiently answer over five million user queries with more than 85% accuracy. Additionally, over 81% of companies compete mostly on the basis of CX and 70% of customer interactions are expected to involve emerging technologies such as machine learning applications, chatbots, and mobile messaging. Clearly, the demand for emerging technologies is skyrocketing in the financial sector.

-

Developing customer-centric products:

Banks are developing and deploying new products with a laser-like focus on increased transparency and great user-friendliness. In other words, banks are focused on creating products that can actually address their core customer’s pain points and minimize friction.

-

Catering to phygital customers:

Approximately 60% of active banking customers use digital channels and 80% of all customer touch-points occur on digital channels. Yet, usage of physical branches and the traditional way of conducting financial transactions in person is not dying down. So, banks are taking the middle route to cater to the needs of the ‘phygital’ customers–those who actively use both digital and physical channels — by driving a seamless, customer-centric, and hyper-personalized omnichannel banking experience.

-

Leveraging cloud-native architecture:

Financial institutions are focusing on creating a centralized digital banking platform–powered by cloud-native architectures and containerized workloads–to deliver increased speed, flexibility, and agility when building new products for customers. In fact, research indicates that 50% of financial firms are steadily adopting Infrastructure-as-a-service (IaaS) to drive cost-effectiveness, boost on-demand availability, and leverage automated scalability. Furthermore, financial institutions benefit from a shorter ideation-to-service timeline, thanks to cloud computing technology.

-

Driving cultural change:

There’s a change in the organizational mindset, with banks wanting to invest in the right tools and processes to free up their IT team. This team can then focus on more strategic tasks, as opposed to engaging in routine and repetitive work with zero value-add. Additionally, banks are working towards better aligning the digital platforms with the organizational goals and restructuring the technology decisions based on the customer’s needs.

-

Rebuilding technology stack:

The financial industry is focusing on rebuilding its tech stack, keeping in mind more business-critical factors such as risk and compliance, operations, and business development. This, instead of solely focusing on the technology’s technical specifications, indicates a win-win-win situation for the users, the leadership, and the bank itself.

-

Utilizing business analytics:

Leading banks are now using the power of analytics in various ways. From employing ML techniques to forecast which consumers are currently engaged and who are likely to leave to looking at competition marketing to see if any banks are offering any needless discounts, the results are varied. In a nutshell, banks are dependent on business analytics services to manage and reinvigorate customer experience.

The Way Forward

Digital transformation is the only logical way ahead if the financial services industry wants to keep pace with the technological, cultural, and societal advancements occurring at breakneck speed. There’s an acute need to build highly-scalable IT systems at low costs, without compromising on the quality of service or falling short of the customer’s growing expectations.