Global Financial markets have not yet recovered since the pandemic, with an ongoing war in Ukraine and rising inflation. When a string of banks collapsed in a matter of weeks in early 2023, it hit the news headlines and triggered government responses at the highest levels.

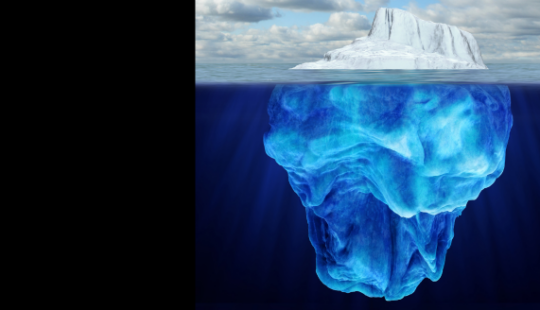

However, there is another looming risk to global financial systems that did not make the headlines. The risk of climate change is so critical that the US Treasury lists it as one of five goals in their strategic four-year plan, alongside topics such as ensuring national security.

How Financial Stability Relates to ESG Disclosure

The impact of climate change is indeed considered a financial security risk globally, and there is a narrowing window for action. In the US alone, the total cost of climate-related disasters since 1980 exceeded USD 2,5 trillion. On the flipside, low carbon technologies present a tremendous economic opportunity, and governments are scrambling to ensure an orderly transition. However, up to $100 trillion of assets revolving around fossil fuels is estimated to be at risk, due to disruptive technologies and shifting government policies.

Environmental, social and governance (ESG) disclosure on a corporate level is a critical component of effective risk management. That is why regulators around the globe are implementing new rules requiring companies to disclose sustainability risks, in line with existing requirements for other risks.

Shifting Towards International Standards

A big shift is needed, before investors will be able to compare companies using not just finance, but also sustainability criteria. In June 2023, the first two global standards were released by the International Sustainability Standards Board’s (ISSB). It means that Sustainability data must be reported with the same scrutiny as Finance data. The standards build on existing frameworks such as SASB (Sustainability Accounting Standards Board), GRI (Global Reporting Initiative), and the Task Force on Climate-related Financial Disclosures (TCFD).

Both the EU and US indicated that they would align with ISSB. Several other countries also indicated that they may adopt these standards, including China, Singapore, and the UK.

Controversy Surrounding New Regulations

The US Securities and Exchange Commission (SEC) proposed a controversial new regulation in 2022. It will require publicly traded companies to disclose how their operations affect the environment. It is encouraging firms to disclose more detailed information about their climate strategies, to increase transparency.

The EU Taxonomy provides a structured frame of reference and a common understanding of economic activities that contributes to environmental goals, such as climate change mitigation or circular economy objectives. It is linked to the EU’s revised corporate reporting rules under the Corporate Social Responsibility Disclosure (CSRD), effective from 2023.

The EU is currently leading the way with the concept of double materiality. This means considering both the impact of the outside world on a company, as well as a company’s impact on the outside world. It is rooted in the view that the world beyond finance can be material, and therefore worth disclosing.

What it Means for Australia & New Zealand

Maintaining investor confidence is crucial for smaller countries and Australia & New Zealand are not isolated from global economic stability trends. New Zealand passed a world first regulation in 2021, with reporting requirements from 2023. Their new Climate-related Disclosure (CRD) requires listed companies, insurers, banks and investment managers to report on how they will be affected by climate change.

Sustainability-related disclosures is also a hot topic Downunder, with Australia’s Securities and Investment Commission (ASIC) urging businesses to prepare for a seismic shift. Voluntary disclosure using TCFD is recommended, and mandatory disclosure will likely be aligned with the international standards from ISSB.

The Outlook for Business Leaders

Regulators need to protect investors from greenwashing and create financial security to facilitate an orderly transition, while shifting investments to where they are most needed. We can expect to see continued expansion and refinement of regulatory reporting requirements over time. Companies who do not act on addressing current and future environmental concerns, could face challenges to get access capital or suffer reputational damage.

Digital reporting practices and assurances are stipulated from the outset in some of the new regulations. The biggest obstacles are data availability, quality, and fulfilling new levels of audit scrutiny. More granular and meaningful data is needed at critical points in operations to make decisions and steer a business towards KPI targets.

Some of the new rules also mandate reporting on scope 3 emissions, which is beyond the boundaries of a single corporation. Voluntary standards are currently lacking, as it uses estimates. A significant shift is expected in this area, with groundwork being done by the World Business Council for Sustainable Development (WBCSD) Pathfinder Framework.

On How to Get Started

Leaders are acutely aware of the need for scalable technology solutions. They ask two essential questions: ‘How can we leverage what we already have’ and ‘how can we keep up with change’? By leveraging sustainability solutions that are fully embedded into ERP solutions, like SAP, additional workloads are minimized. Not only does this produce audit-ready data, but it also allows data-driven, fact-based decisions.

To find out more, visit sap.com SAP Sustainability Control Tower