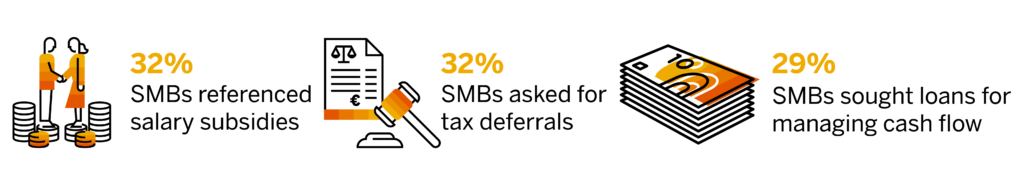

In a survey conducted by Facebook, the OECD, and the World Bank of more than 30000 MSMEs across 50 countries, 32% SMBs referenced a need for salary subsidies, another 32% asked for tax deferrals and 29% sought access to loans and credit to offset ongoing cash flow and demand-side problems. In India, the percentage of MSMEs with access to formal credit systems varies between 16 to 30% in various reports. While the banking penetration is almost complete, access to formal credit remains a challenge. The rigid credit disbursal processes and lack of understanding of the documentation needed to seek credit limits through formal channels are the major constraints. These are being addressed through various start-up schemes and financial inclusion programs.

While the larger credit issues are being addressed by the Governments and regulators, MSME Owners and Senior Management need to define their strategy and create activities to come out of the prevalent challenges. With a clear understanding of their Operational and Financial Strengths, MSMEs would be able to survive, sustain and grow by adopting a 2-pronged approach – Internal Optimization and Building Global Outlook.

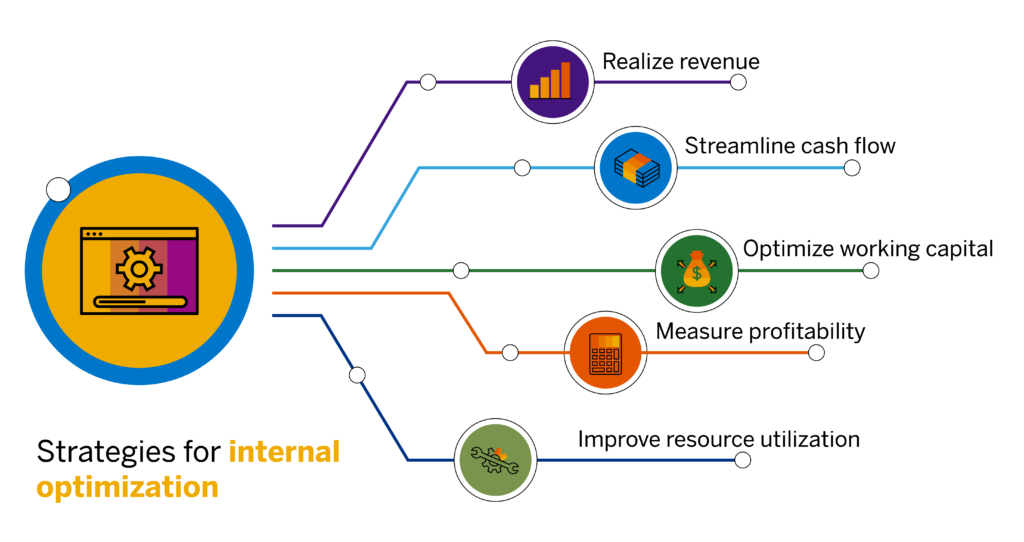

Internal Optimization

Depending on their challenges, an MSME may use the following strategies:

- Survival

- Sustenance

- Growth

Let me share actions that will support these strategies:

- Realize Revenue

- It is important to collect the “Complete” payment against each order in agreed timelines

- Assign a dedicated resource to monitor the Payment Collection

- Incentivize early payments

- Streamline Cash flow

- Monitor monthly inflow and outflow

- Identify Shortfalls

- Explore ways to fulfill the shortfall from receivables

- Optimize Working Capital

- Monitor Monthly Working Capital Deployment

- Identify the reasons for excess deployment

- Prepare an Action Plan to reduce the amount of working capital deployed

- Check Cost of Working Capital for each month

- Use new options like Receivables Exchange of India, Bill Discounting through Banks and Purchase Credit Platforms

- Measure Profitability

- Measure Profitability for each Product / Service / Client

- In case of lesser profitability/loss check with the Sales / Production team

- Initiate Corrective Actions

- Improve Resource Utilization

- Develop Resource Utilization Reports

- Initiate daily short duration review meetings

- Conduct weekly review meeting

Building Global Outlook

Adopting Digital First Approach that would enable MSMEs to target the World Market while letting Systems drive Internal Processes / Controls. MSMEs need to start the internal Operational Efficiency drive by Implementing an ERP System that would give them a comprehensive integrated view of Financial and Operational parameters. Having multiple systems creates data silos and impacts the efficiency adversely. MSMEs may use Cloud as IT Infrastructure and Software as a Service to reduce Capital Investments. This approach will enable MSMEs to drive Digitalization / System Adoption faster. This would improve Business Efficiency and create a strong platform for these MSMEs to capture Growth Opportunities. MSMEs may follow the following steps to help them get a better perspective:

- Understanding the Opportunity

- Preparing to capture the Opportunity

- Initiating the Global Outlook

With these simple steps, MSMEs will be able to get a better perspective of the opportunities available across the world. Once MSMEs start searching more, reaching out to few clients and have initial conversations, their understanding will evolve. They will be able to appreciate various opportunities and explore ways to capitalize on those opportunities.

Discover the latest insights and recommendations from IDC Info Snapshot, “Business Reimagined: Protecting and Growing Revenue,” sponsored by SAP that can help you drive continued growth, even during times of volatility.