Micro, Small and Medium Enterprise (MSME) are the backbone of any developing economy. While the large corporates enjoy the limelight, the SMEs work silently to enable economic activities. China has the largest number of MSMEs followed by India. A report published by the Office of Advocacy in the US in 2019, indicated that 44% of the economic activities happen through MSMEs. Around 60 million Micro, Small and Medium Enterprises in India employ nearly 40% of the non-agricultural workforce and contribute around 36% to the GDP. Their contribution to export is nearly 50% in developing economies. MSMEs have a significant social impact as well. The Cooperative Enterprises and Distribution of the SMEs across the geographies make them critical instruments of employment and economic development.

What is a MSME?

The Government of India has enacted the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 which defines micro, small and medium enterprises engaged in the manufacture or production, processing or preservation of goods as specified by investment. A micro enterprise is an enterprise where investment in plant and machinery does not exceed Rs. 25 lakh, a small enterprise is one where the investment is more than Rs. 25 lakh but does not exceed Rs. 5 crore and finally a medium enterprise is one where investment is more than Rs.5 crore but does not exceed Rs.10 crore.

MSMEs may be categorized into Trading, Manufacturing, or Service enterprises based on their activities. The individuals promoting each type of enterprise demonstrate distinctive characteristics. Traders are very good with numbers. Manufacturing set-ups are created by Technology enthusiasts passionate about a problem they would like to solve. Service Enterprises work with a mindset to improve the life of the target client base with their services. These enterprises experience different growth curves based on a variety of External and Internal factors. While External factors are beyond their controls, the SMEs need to work on the internal factors to ensure that they remain agile to capitalize on the growth opportunities.

Ongoing Pandemic and resultant lockdowns have hampered the economic activities globally. The cascading effect on SMEs has been distressing. Globally, more than 90% of the SMEs have been impacted. These SMEs reported Revenue Decline in the range from 20% to 90%. Adoption of Technology proved to be the critical factor for the SMEs to resume operations under restrictions.

Historically, an economic downturn of this magnitude leads to a bigger peak in the subsequent recovery cycle. The Economic Recovery has already started. Various international agencies have reported the developing economies to grow between 8 to 12% this year. This recovery will create tremendous growth opportunities for SMEs.

To prepare for the growth opportunities in the post-COVID World, all the SMEs need to:

- Assess their Current Situation realistically

- Benchmark Themselves against peers and industry standards

- Identify strategies to address their current challenges and grow

In this article, we are going to focus on the Assessment part.

Assessing the situation

We are going through unprecedented times. The MSME owners or Management has not faced such situations earlier. Hence, all the stakeholders must come together and realistically assess the status. As the situation is continuously evolving, the company also needs to calibrate the response periodically. For successful calibration, the company will need to create a baseline.

To establish this baseline, MSME Owners need to review their business in the following 3 phases:

- Pre-COVID Era

- Pandemic Period

- Unlocking Phase

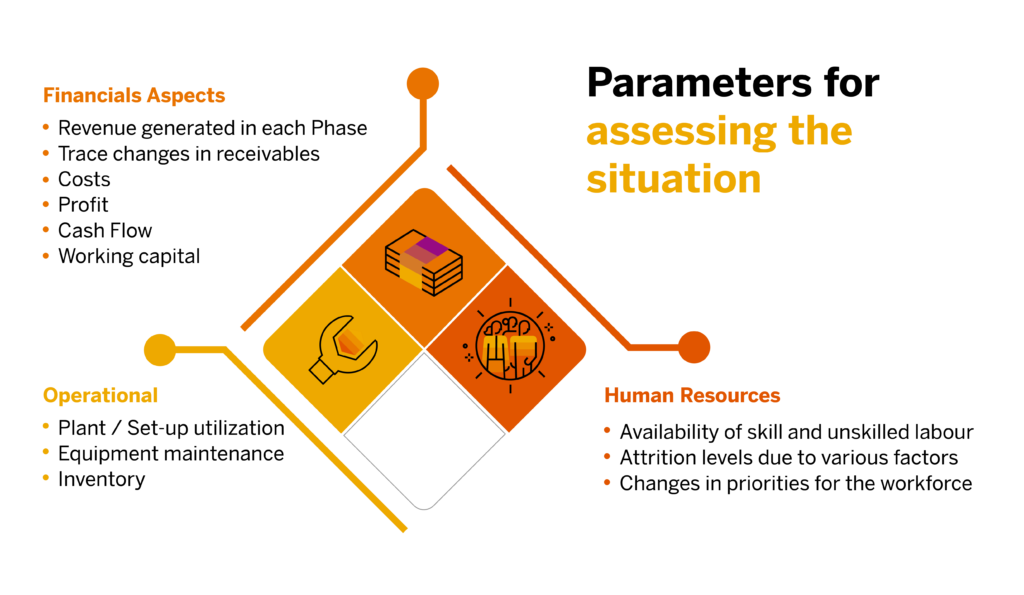

SMEs need to take a comprehensive review of their business spanning across all the functional areas. The following parameters need to be covered. Click here to download the complete checklist

- Financials Aspects

- Revenue Generated in each Phase

- Trace changes in Receivables across the 3 phases including:

- Costs

- Profit

- Cash Flow

- Working Capital

- Operational

- Plant / Set-up Utilization

- Equipment Maintenance

- Inventory

- Human Resources

Assessment of these parameters will help an Entrepreneur / Senior Management get a clear understanding of the status. Having an ERP system like SAP would be a great advantage as it would capture most of the data required for the assessment. ERPs provide preconfigured reports for Profitability, Monthly Cash Flow and Operational Efficiency. This would enable companies to conduct effective monthly reviews.

In the first of the MSME thought leadership series, we bring you three guides with downloadable checklists to prepare your business to become more agile, efficient and resilient. In the next article, we will discuss how an your enterprise can benchmark itself against the industry’s best practices.

Midsize businesses today are thinking about how their operational efficiency and agility can help them to weather future storms and seize new opportunities along the way. In fact, 33% of midsize business identify “becoming more agile and flexible” as a top five priority, according to the IDC Info Snapshot, “Business Reimagined: Driving Greater Efficiency and Resiliency,” sponsored by SAP.

Read the IDC Info Snapshot to discover how your business can connect, grow, and win by renewing efficiency and agility with more resilient supply chains, data-driven decision-making, and a workforce supported by intelligent systems.