The second part in the series by Manish Prasad, Head of Industries, SAP Indian Subcontinent, explores the Indian sustainability landscape set against broader global shifts towards a greener tomorrow. This edition looks at two key trends: the financial implications of the lower cost of greener capital and the Indian consumer’s shifting preferences for more sustainable products and services.

The emerging Environmental, Social, and Governance (ESG) mandate in corporate governance presents a new challenge for Indian companies. This rides upon the Indian Government’s focus on the need to adopt ethics, transparency, and accountability among businesses to promote responsible and sustainable business practices. The focus now is on how these sustainable growth practices will contribute toward value creation for the companies and their stakeholders. ESG-led discussions are finding more airtime in discussions on decisions around mergers, acquisitions, and divestitures, as well as new product launches and innovations. But how do these factors relate to corporate performance and structuring deals? While in the previous edition, we looked at shifts in governance and reporting, this edition explores the fast-changing financial and consumer preference landscape.

Financial Performance: How the lower cost of greener capital is driving ESG decisions

One of the first questions asked in boardrooms is this: “To what extent does good ESG translate into good financial performance?” The easy answer is that there is an overwhelmingly positive relationship between ESG scores on the one hand and financial returns on the other, whether measured by equity returns or profitability, or valuation. But interestingly, there is a new element in the mix: the cost of capital. There is increasing evidence that a better ESG score translates to about a 10 percent lower cost of capital as the risks that affect your business, in terms of its license to operate, are reduced if you have a strong ESG proposition.

Source: Forbes

In a four-year study published in 2020, Morgan Stanley Capital International (MSCI) reported that companies with high ESG scores experienced lower capital costs than companies with poor ESG scores in both developed and emerging markets

Source: MSCI

Moreover, the cost of equity and debt followed the same relationship. All these studies continue to indicate that incorporating ESG into the management framework helps companies enhance the efficiency and value of the organization while lowering downside risk. While experts agree that investing in companies that do well on ESG standards is a comparatively new theme in the Indian market, it is only a matter of time before this becomes the norm.

Consumer Preferences: The Shift to Green

We are seeing a definite green shift in the preferences of the Indian consumer after the global pandemic. Sustainability and health have become important factors when making purchase decisions. Of the Indian consumers surveyed in a recent global study, 78% were willing to change their purchasing behaviour to reduce a negative impact on the environment. (Source: LiveMint) Urban Indian consumers are most willing to do this. The percentage of respondents is the highest across all countries surveyed.

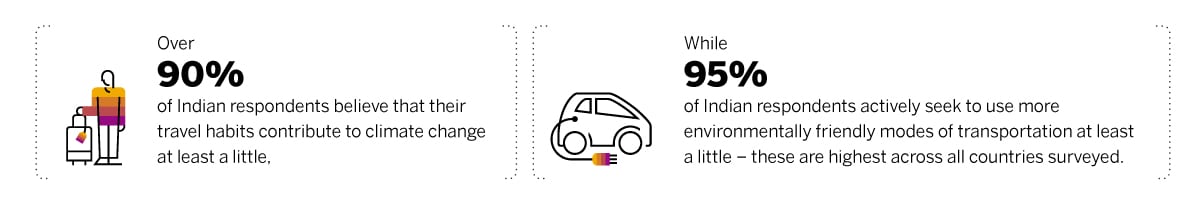

Moreover, Indian consumers are at the leading edge of the shift compared to other countries studied, including the United States, India, United Kingdom, Canada, Germany, Mexico, Spain, Brazil, and China. Across various parameters related to lifestyle choices and shopping behaviour, those surveyed in India showed higher awareness and concern for sustainable alternatives. For example

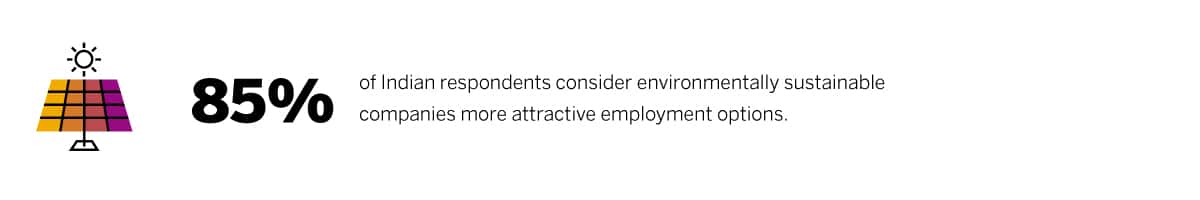

This makes it amply clear that the Indian consumer, particularly from an urban background, is increasingly concerned about the global climate crisis. If you’re a company stepping up your response to sustainable practices, such as adopting greater use of renewables in your supply chain, reducing plastic waste, and investing in ESG outcomes, your consumer will notice. Nowhere is this better illustrated than the study of Indian consumers that reported that 48% of consumers share an emotional connection with products or organizations that demonstrate eco-friendly qualities.

The shift doesn’t affect the purchase behaviour alone.

Source: Business Insider

In conclusion, the trends driving ESG in India foretell a future we will not have to fashion. We are on an inevitable march towards a greener tomorrow, led by markets and consumers. The successful organizations of the future will see that shift today before it comes as a surprise.

In the subsequent post, we will deep dive into industry–specific imperatives for ESG.

Follow Manish on LinkedIn