Coming on the heels of a global pandemic that changed the way we live and work, the war in Ukraine has deepened the uncertainty and instability we face. If any good is to come from these disruptions, it is that organizations have been given the opportunity to reinvent themselves for the better. They can reimagine how they innovate, operate, and create value for all stakeholders by leaving behind practices of the past and embracing the vision of sustainability for the future.

Decisions based on sustainability principles are crucial to navigate today’s complexities, cope with near-term strains, and adapt to a changing global system — all while creating the foundation for growth in the years ahead.

There are three concepts that leaders must prioritize as they chart their course to sustainable business:

1) Accelerate Renewable Energy Use

Europe is reliant on fossil fuels. Prior to the war in Ukraine, Europe imported about 40% of its gas and more than a quarter of its oil from Russia. While the EU has turned its back on Russian coal, it is struggling to agree on how and how much to boycott Russian oil and gas. Many countries are looking for alternative sources, with the U.S., Saudi Arabia, Venezuela, and other producers filling the gap.

The industrial sector uses about 54% of the world’s total delivered energy, more than any other sector. More than 80% of that energy is still produced by fossil fuels. It is clear that energy and climate policies will be impacted in the short term. The war will likely extend fossil fuel use, putting the timeline to reach net-zero emissions at risk. If we are to avoid slowing or reversing our progress toward our net-zero goals, the private sector must accelerate its transition to renewable energy use.

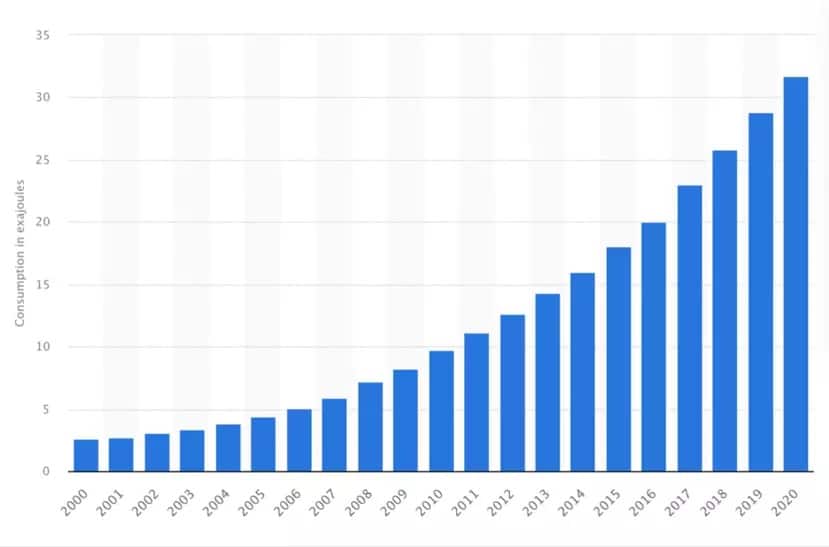

Renewable energy costs have decreased dramatically over the past 20 years, and use has increased accordingly. However, to achieve a secure, sustainable, and economically feasible energy system, government and business leaders need to work together to form policy and finance environments that encourage rapid uptake. Clean energy technologies, coupled with energy-efficiency solutions, are essential to reduce emissions.

Companies must formalize their energy strategy and support the deployment of renewable energy sources, which are largely domestic, safer, more secure, and less costly at scale. To this end, they can prioritize self-produced energy or commit to using 100% renewable electricity. They can form partnerships to develop renewable energy infrastructure projects, and join coalitions like the RE100.

2) Participate in Collaborative Networks

Russia’s invasion of Ukraine has increased the instabilities of global supply chains and intensified the scarcity of important resources. Developing stable, reliable, and sustainable supply chains require data-rich, connected business networks. These networks will provide the transparency to better manage resource availability, offer essential products and services, address unethical conduct, and reduce environmental impacts.

For example, more than 30% of worldwide food produced is lost or wasted because of inaccurate demand calculations or transport issues. Ukraine has large lithium oxide deposits. With batteries being the most expensive part of electric vehicles, rising prices of nickel and lithium can slow market adoption.

The conflict may also give rise to unethical labor practices, making monitoring human rights and working conditions across supply chains crucial. With sustainability-centered planning and technologies, governments, companies, and NGOs are better prepared to manage crisis response; for example, in case of natural disasters or social emergencies.

Industry data networks like Catena-X and the World Business Council for Sustainable Development Carbon Transparency Pathfinder enable companies to manage sustainability performance across supply chains. This includes materials sourcing, accumulated carbon emissions in products, and reusability at a product’s end-of-cycle.

3) Leverage Sustainable Finance

Business leaders often assume that being more sustainable means being less profitable. This is not the case. Transforming to a low-carbon, low-waste, low-inequality economy and leveraging sustainable finance represents a massive opportunity.

The capital markets are greening. Sustainable bonds are surging, and a majority are now corporate issuers. Sustainable lending grew by 300% last year. Companies with sustainable credentials are increasingly becoming targets for M&A deals. Despite equity market swings, equity values of sustainable companies were up 46% on average in 2021.

Financing the transition to sustainable companies and economies means business leaders must move away from prioritizing only shareholder returns to a broad set of stakeholders, including employees, communities, customers, partners, regulators, and, importantly, nature. Sustainable finance can accelerate business investments in nature-based solutions like protecting forests and other carbon sinks to regenerating ecosystems and supporting biodiversity.

Increased environmental, social, and governance (ESG) reporting standards force companies to accurately collect, organize, and report their impacts to multiple standards. Investors want greater disclosure as they see not only regulation but trends in consumer and employee demand. They want more sustainable products, services, policies, and business performance; they want to work for responsible companies, and they are more engaged. This helps create economic opportunities and stabilize employment.

Business leaders must play a role in a “just transition,” helping emerging markets as they face the biggest risks from climate change and ESG challenges. The pandemic and the war in Ukraine have placed a combined strain on emerging markets, with a disparate impact. Aid and support funding from Western governments, which was already under-delivered, is being redirected to military and humanitarian support in Europe.

There’s an increasing desire for this investment support. ESG investments now make up almost 18% of foreign financing for emerging markets excluding China, four times the average over recent years. Sustainable finance can provide strong returns while directly addressing climate, biodiversity, and social inequality challenges.

As a key driver of sustainability impacts, the private sector has an important role to play in urging policy action, improving the sustainability performance of operations, products, and supply chains, providing sustainable finance, and innovating solutions at scale. Together, we can drive positive outcomes for the planet and our communities, and secure long-term security, stability, and equitable economic progress for all.

Christian Klein is CEO of SAP SE.