There is no shortage of crises in the headlines today. Stories on the ongoing pandemic, floods, wildfires, droughts, wildlife extinctions, racial and gender injustices, and corporate corruption fill our screens. The role of businesses around the world to pull together and collectively contribute to solving these problems is more urgent than ever.

But across global boardrooms there remains a philosophical divide about the purpose of business. It is becoming more apparent that the concept of “shareholder capitalism” — putting corporate earnings above all else — is a diminishing notion. Resurgent is “stakeholder capitalism,” where business considers the broader interests of investors, employees, society, and the planet.

Top executives are prioritizing environmental, social, and governance (ESG) activities that support the interests of the broader group of stakeholders. Time is of the essence because the impacts of climate change and biodiversity loss are plainly obvious. ESG topics are affected by more stringent regulations as well as employee, customer, and investor scrutiny. It’s also increasingly clear that strong performance in these traditionally non-financial issues is a competitive advantage and supports long-term value creation. With companies making a slew of ambitious public commitments, from diversity to net-zero, it is clear that measuring performance will be essential to effective management, performance assessments, and collective achievement.

For years, companies have reported their ESG or non-financial performance. This kind of reporting is increasingly mandatory for listed companies, while private and smaller companies are increasingly reporting voluntarily.

The challenge for all of them, however, is the broad range of reporting frameworks and standards. More than 100 ESG reporting guidelines are in use, oftentimes conflicting and redundant, making it virtually impossible for executives, investors, and other stakeholders to determine credible progress or compare impacts across different companies and industries. Ninety percent of corporates said that a set of universal ESG metrics and disclosures would be useful for financial markets and the economy. Consolidation around a universal, comparable set of reporting standards is urgently needed.

The World Economic Forum’s (WEF) International Business Council (IBC) asked a number of global accounting firms to agree on a set of ESG metrics that all companies can use as a “foundation” in their ESG reporting. Drawing from the range of existing widely used frameworks and standards, the World Economic Forum Stakeholder Capitalism metrics were released last year. The initiative aims to accelerate the convergence of reporting standards. The framework uses a set of measures to value and report the business performance across four “Ps”: Principles of Governance, Planet, People, and Prosperity.

Today, more than 100 companies have committed to the concept of stakeholder capitalism and support using the WEF metrics. Around 30 companies have already begun implementing them in their corporate reporting. In the few years ahead, rapid adoption and use of the WEF metrics by thousands of companies, as well as cooperation among other standards organizations and regulators, will be crucial to the widespread support needed to accelerate convergence.

SAP has committed to the WEF Stakeholder Capitalism metrics and encourages further global standardization and convergence in the ESG reporting landscape. We offer support to the initiative by including the standards in our own global reporting and also offering the framework in our core sustainability software solutions. Our hundreds of thousands of international customers, including 80% of the Fortune 500, are encouraged to implement the Stakeholder Capitalism metrics. Companies that already have established reporting systems can add the WEF framework, and companies just beginning to report can use the framework as their starting point.

The metrics will be recommended in our

sustainability software solutions to help fast-track a

vital “core and common” reporting language.

The areas covered in the four Ps have been translated into a set of 21 core metrics, which are seen as critically important across industries. A number of additional measures are available to provide more detail and industry-specific information. The metrics are supported in our sustainability software solutions to help fast-track a vital “core and common” reporting language.

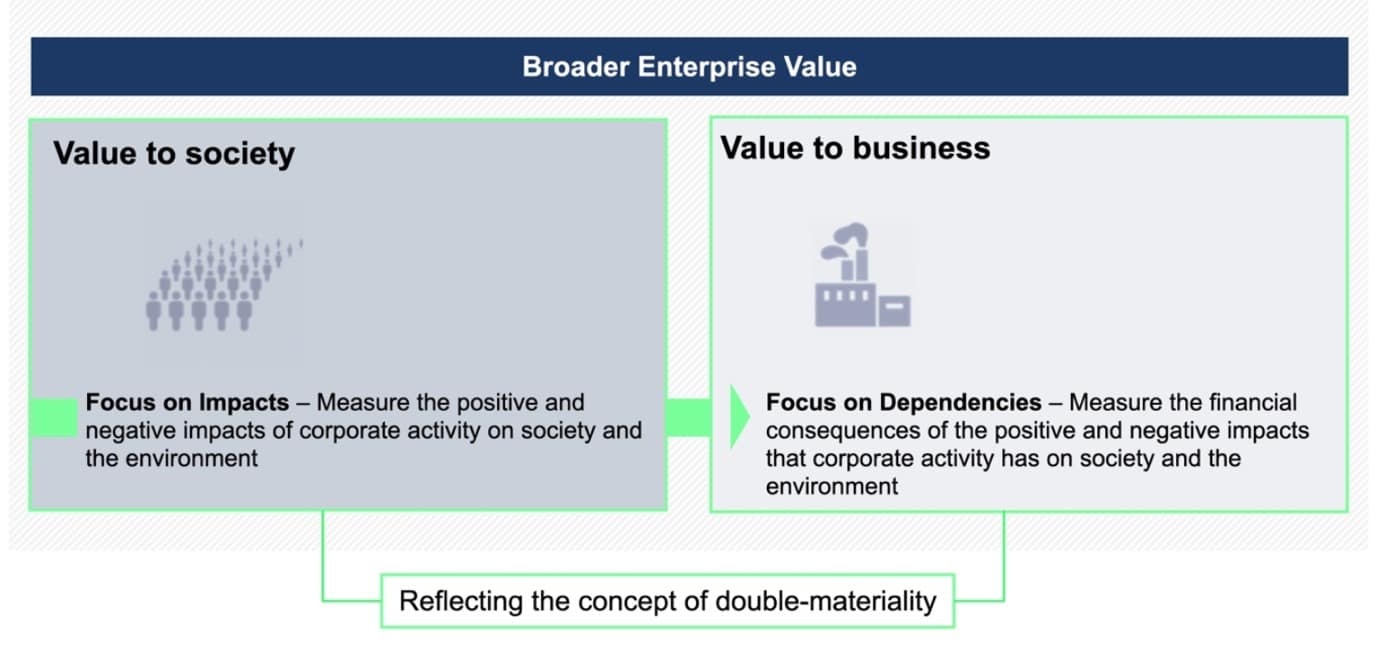

Converging the overly complex world of ESG reporting and understanding the stakeholder perspective of how companies positively and negatively impact society is the first step. A vital evolution will be the widespread adoption of a value-to-business perspective and applying financial values to these traditional non-financial ESG actions. It is an important distinction between reporting the performance of an ESG metric and putting a monetary value on an ESG performance.

For comparability and holistic corporate management and decision-making, it is essential to monetize impacts in financial terms and include them in disclosures. This financial-driven view clarifies how these ESG impacts affect the company’s financial performance. Both perspectives are intrinsically related and are often referred to as “double materiality.”

Both perspectives are fundamental for understanding a company’s long-term value creation. SAP is a founding member of the Value Balancing Alliance, which aims to standardize measurement and valuation methodologies to put ESG impacts on the P&L statement, act as practitioner’s lab and pilot the methodologies to create a unified voice for the industry.

The VBA and the Stakeholder Capitalism metrics are similar and share a common goal. In April of this year, the VBA and the WEF issued a joint announcement supporting a shared view on accounting standards.

Way back in 2013, a prescient Peter Bakker, CEO of the World Business Council for Sustainable Development (WBCSD), said that accountants would save the world and that we needed to change accounting rules. Those changes are coming. We believe standardized approaches to valuating ESG impacts should be established globally. A “balance sheet” set of impact measures is not enough; we also need an impact profit-and-loss sheet.

With financial values assigned to these traditionally non-financial ESG measures, a new accounting standard is required. Organizations like the International Financial Reporting Standards (IFRS) Foundation are now considering broadening their mandates to include sustainability issues. All major reporting standards groups and the WEF are part of a core working committee of the IFRS on a new accounting standard. Their approach is scheduled to be announced at the upcoming COP26 in Glasgow in November.

As industries and markets mature, they tend to converge and establish clearer standards, processes, and players. In the rapidly expanding area of corporate ESG measurement and reporting, we encourage the use of technology solutions to more efficiently capture, manage, analyze, and use sustainability data for better sustainability stewardship.

Companies across industries, supply chains, and geographies will have to focus their disparate systems to better support data collection and management, supplier connectivity, employee and customer engagement. This is essential for competitive decision-making and making investments in activities that support stakeholder capitalism.

When global business has more connected, validated, and accurate sustainability performance information, combined with a shared vision and common reporting and valuating language, we will have the power to achieve our most ambitious goals together.

Daniel Schmid is chief sustainability officer of SAP SE.