Last year, more than half of operational MSMEs surveyed throughout the world disclosed a year-on-year monthly decline in revenue of more than 50%. In a survey conducted by Facebook OECD and World Bank in 2020, the majority of MSMEs (62%) operating at the time of the survey reported that they generated lower sales in the previous 30 days compared to the corresponding period in 2019. The intermittent lockdowns during 2021 are stressing the MSME growth in developing nations further. The decline in revenue and changing consumption patterns are compelling SMEs to reassess the business viability.

Governments and Markets have been monitoring the evolving situation and responding dynamically. The large corporates have the requisite skill and technology to assess the emerging situation and plan their strategy. What should be the way forward for MSMEs? With limited resources and skills to assess and monitor the situations, MSMEs need a different and simpler approach. MSMEs can benchmark themselves against their previous performances and the industry standards. They can define targets and work towards achieving those targets.

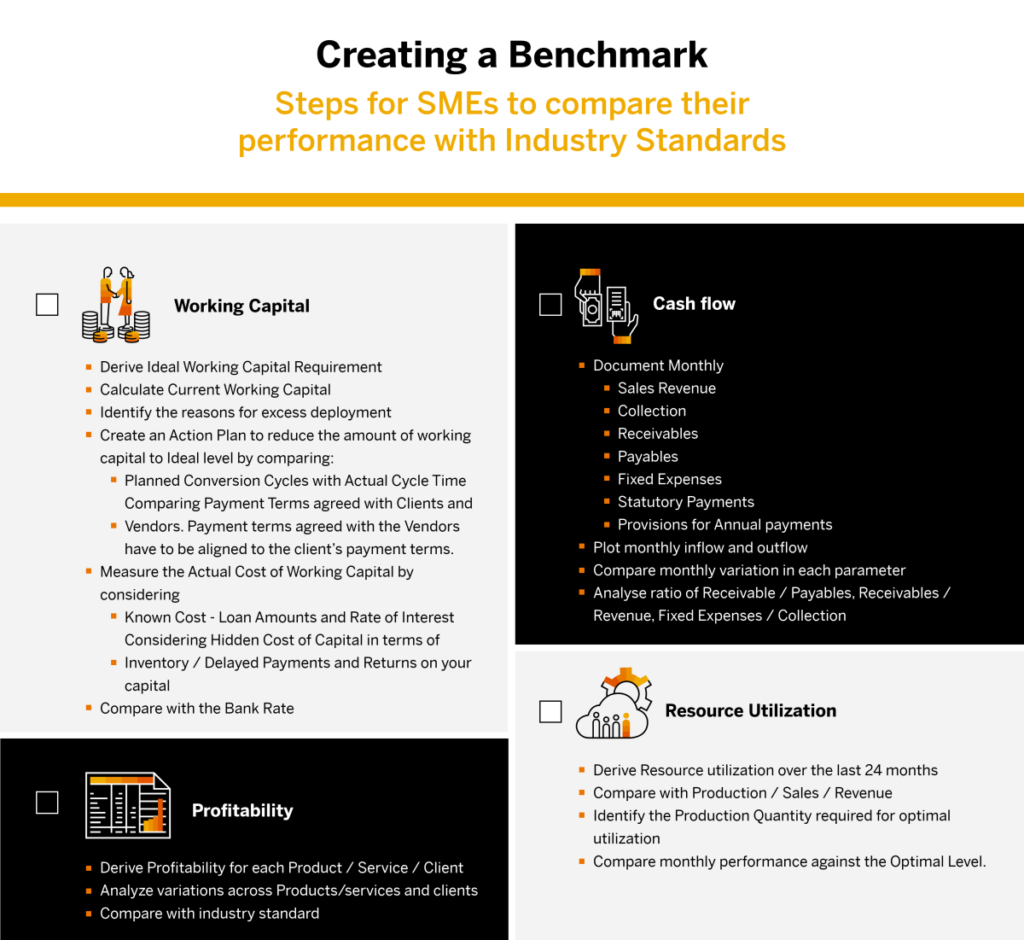

A MSME may use the following steps to create benchmarks across processes/functions. The current performance may be compared with the previous best performance or Industry standards.

- Working Capital

- Cash flow

- Profitability

- Resource Utilization

While the industry standards vary across sectors and geographies, some common parameters can be benchmarked against the best practices.

- Inventory Levels

- for companies with non-seasonal inputs, Inventory Levels should be close to the average monthly purchase.

- This will indicate faster inventory turnover and lesser chances for inventory scrapping

- Inventory Ageing

- Under the current circumstances, a company may hold any material which can be converted into finished goods in the next 3 months.

- If there is any older inventory, it is advisable to liquidate the same.

- The material nearing expiry in the next 6 months needs to be used for production or sold out at the earliest.

- Receivables

- Receivable should be close to monthly sales.

- This will indicate the continuous flow of orders.

- In the case of project companies, the receivables may be compared to the projected cash flow.

- Payment Collection

- Payment should be collected on agreed terms.

- The delay will lead to additional working capital requirements.

- Payables

- Payables need to be equal to monthly purchases.

- Compare the agreed payment terms with actual payment.

- Plot payment receipt from a client with the payment made to corresponding vendor payment.

- Any advance payments will increase the Working Capital Requirement and Cost of the Product.

- Cash flow requirements

- The monthly Cash flow gap should be within the Banking Limits available for the SME

- In case the gap exceeds the Bank Limits, the company will need to delay payment for borrow funds to meet this gap.

- Profitability

- Define Profitability Target

- Calculate the Cost of the Product by estimating the cost of your investment to be at the interest rate twice the Bank Rate of Interest

- Set a target of a minimum of 10% profit on top of this cost.

- The profit margins for companies with patented solutions/niche products may be higher.

- Compare Monthly Product / Service / Client-wise Profitability with the target.

- If the business is profitable with the above cost, your capital will grow over a period of time. Otherwise, you will need to reworks Sales Prices or Costs.

- Define Profitability Target

Availability of historical data helps companies identify the best performances over the years and correlate various parameters facilitating the best performance. Company management needs to critically analyze these parameters and establish the benchmarks. Once these numbers and indicators are agreed, company may develop reports in the ERP system to review the present performance against these benchmarks. Use of ERP system for benchmarking will ensure that Owner / Management focuses on analysis rather than the data collection.

This will help MSMEs create a baseline for their business. This baseline would help MSME Owners and Senior Management plan across the phases. At the survival stage, they will be able to estimate Breakeven Point and work towards achieving the same. During the sustenance phase, benchmarks will help them conserve cash for Growth. In the Growth phase, these benchmarks would help the company pursue newer opportunities without compromising the fundamentals.

In the second of the MSME thought leadership series, we bring you guides with checklists to prepare your business to become more agile, efficient and resilient. If you missed the previous article about assessing and improving business efficiencies, do check it out. In the next article, we will discuss how an your enterprise can address specific strategies for growth.

Companies large and small are now contemplating how to reopen, recover, and return to profitability after a long pandemic-induced pause. And for 61.6% of midsize companies, this line of thinking includes the possibility of competing in new markets to grow steadily and organically, according to IDC.

Find out how you can compete effectively with the latest insights and recommendations from the IDC Info Snapshot, “Business Reimagined: Competing More Effectively,” sponsored by SAP, such as why data is a critical part of enhancing competitiveness

which emerging market realities must be addressed strategically and how an interconnected digital system supports agile decision-making