Mexico’s oil and gas market has been in transition since before COVID-19 impacted oil prices and pushed oil-rich nations to reduce output. Faced with flagging oil production, the government opened the industry to foreign investment in 2014 and allowed private Mexican petroleum companies to manage oil field operations.

This marked a significant change. Since 1938, the petroleum industry had been a monopoly held by the state-owned Petróleos Mexicanos, known as Pemex. Until the reforms, only Pemex could run drilling operations and exploit new sources of oil.

Alejandra López is a director at FTI Consulting and former analyst at Pulso Energético, a think tank in Mexico’s oil industry. She explains that the legislation’s main objective was to make the energy sector more competitive and dynamic. As a monopoly under Pemex, it was slow.

“We weren’t developing our energy resources fast enough or with the best efficiency,” Lopez said. “With the reform, Mexico opened the opportunity for the best companies — from both here and abroad — to bring the best technology and resources to bear.”

Enter companies like Grupo R , a 60-year-old organization based in Mexico City that formerly provided on- and offshore drilling services to Pemex including gas field operations, offshore construction and maintenance services, oil and gas infrastructure, and exploration. The conglomerate of about 36 companies supports the oil and gas market across three sectors: energy, services, and infrastructure.

Grupo R is now a major player and recently inked deals with global oil companies like Shell Mexico and Hokchi Energy, S.A. de C.V, both subsidiaries of foreign oil groups, to take advantage of Mexico’s vast oil reserves. With 7.7 billion barrels in reserve, Mexico ranks in the top 20 of oil-rich nations worldwide, so the opportunity is huge.

Grupo R has bet on the Internet of Things (IoT) and information technology innovation to help it standout from competitors as multinational petroleum giants consider investments in Mexico.

“The oil and gas world came to Mexico with the energy reform. All the global companies started tenders in Mexico, but they come with first-world standards,” said Jonathan Salazar, chief information officer of Grupo R.

Grupo R Turns to SAP

To meet these requirements, Grupo R turned to SAP.

“To be competitive and work with companies like Shell, our c-level executives wanted internal controls, security, and the ability to standardize all systems and processes across our companies,” Salazar explained. “We needed one version of the truth and only one interface.”

His team started with the intelligent, cloud-based enterprise resource planning (ERP) system SAP S/4HANA as the foundation to automate and harmonize business processes such as finance, materials, and production. In addition, SAP Analytics Cloud and SAP Digital Boardroom provide holistic business insights more quickly. New mobile capabilities have sped up approvals, since they can be done anywhere.

The company also integrated SAP SuccessFactors solutions with ERP for employee-related services like payroll, onboarding, and career planning. To manage its customer leads and opportunities, which is particularly important during the private tender process, Grupo R uses SAP Sales Cloud.

López agrees with Salazar: Technology will facilitate companies’ success, even in the current climate of low oil prices. “The energy industry is very technical. The only thing that will differentiate them and help them win new contracts is who gets the best technology and appliances for their portfolio,” Lopez said.

That’s why many like Grupo R are investing in new talent and solutions that will reduce time and increase efficiency.

Predictive Maintenance for Offshore Drills

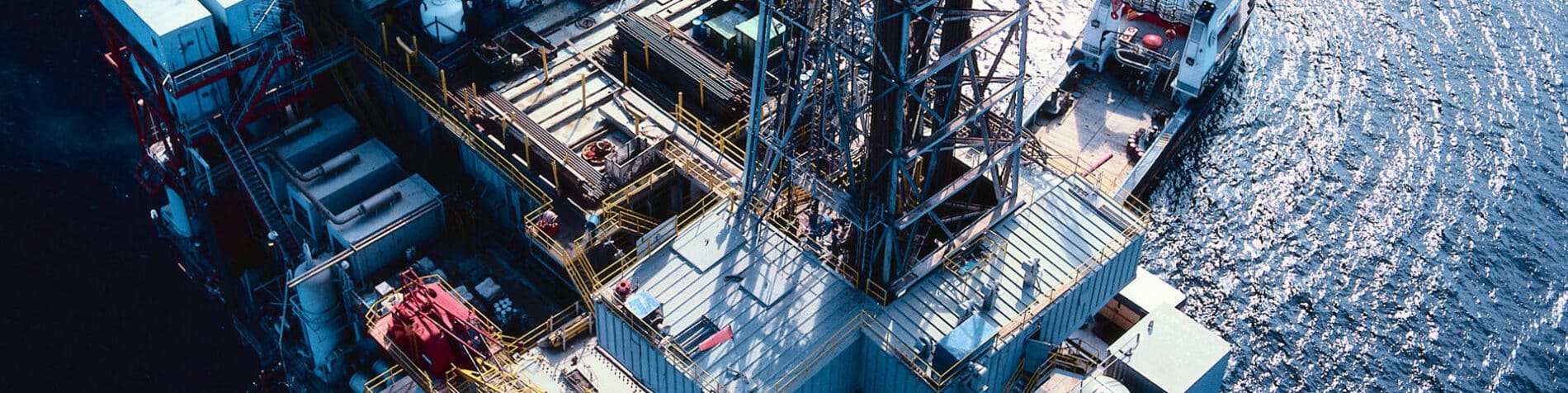

One example is Grupo R’s investment in state-of-the art jack up rigs used for offshore drilling. The company recently introduced the Cantarell IV rig, equipped with proprietary digital capabilities that better support the platform’s entire life cycle. More than 4,000 sensors are installed onboard — considerably more sensors than usual, Salazar points out — allowing the company to analyze drill platform and equipment-related data in real time.

He says that all aspects of the oil and gas industry depend on technology, but to differentiate in an emerging market, companies must have the latest and greatest: “My role is to connect operational technology that comes from the physical aspects of the business to informational technology.”

With this integration, the company would like to create a predictive maintenance system for its offshore rigs. A current pilot program brings select sensor information into SAP S/4HANA to help monitor rig performance. Data is sent to equipment owners and cross-referenced with technicians’ experience data, so they can proactively identify and fix issues.

In future, Salazar wants to develop artificial intelligence (AI) algorithms fed with historical information and predictive data related to drill performance. This will help automate processes and better anticipate how to respond effectively to specific problems. He also wants to create a solution that people can use on- or offline, because drills aren’t always connected, to support business continuity.

Grupo R chose SAP for its oil industry experience and regional experience. “In Mexico, we have regulatory agencies that don’t have equivalents elsewhere. With SAP, we were able to use best practices that met our specific needs quickly,” Salazar said.

Moving Forward

Meanwhile, the Mexican government recently stopped accepting new foreign tenders for its private companies and Pemex faces over $100 billion in debt. And of course, there’s the looming global recession combined with unprecedentedly low oil prices.

Mexico has a big challenge ahead: how to develop resources in the most efficient way, given the current market conditions. But to be set up for future success, technology investments and innovation must continue. As Lopez points out, “Oil production tomorrow will depend on technology developments today.”